AG SALES & USE TAX EXEMPTION

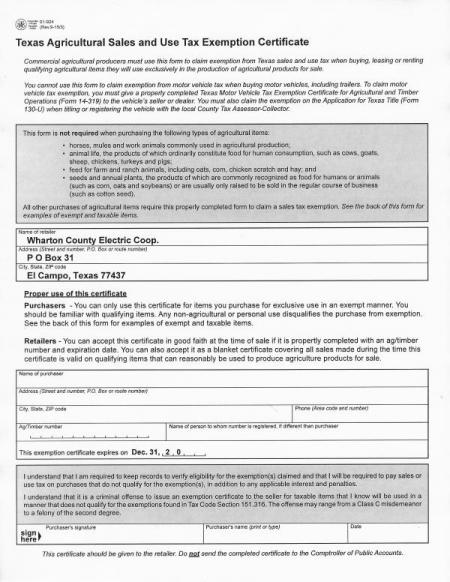

Every four years, all Texas Agricultural Sales and Use Tax Exemption Certificates (Form 01-924) on file with Wharton County Electric Cooperative expire.

Before the first day of the year following expiration, a new tax exemption certificate showing the Ag/Timber number must be on file with WCEC. This form is available for download at below. We can only accept Form 01-924 to verify your Ag/Timber number.

If WCEC does not receive an updated sales tax exemption certificate by January 1, those non-residential accounts will be coded as taxable. These accounts will not be coded as tax-exempt until the proper registration number is provided to WCEC.

Wharton County Electric Cooperative cannot accept an exemption certificate without a Texas Ag/Timber registration number. To apply for or renew your Ag/Timber registration, visit the Texas Comptroller's website at https://comptroller.texas.gov/taxes/ag-timber.

For more information, please contact us at 979-543-6271.